Old Is Gold For Jordan Airmotive

Following a very profitable 2023, engine overhaul provider Jordan Airmotive expects another year of growth in 2024 as it fields requests from airlines in Asia, the Middle East and Europe.

“MRO Europe is very useful to us, it’s where the major operators are,” says Walid Rihani, deputy CEO of Jordan Airmotive.

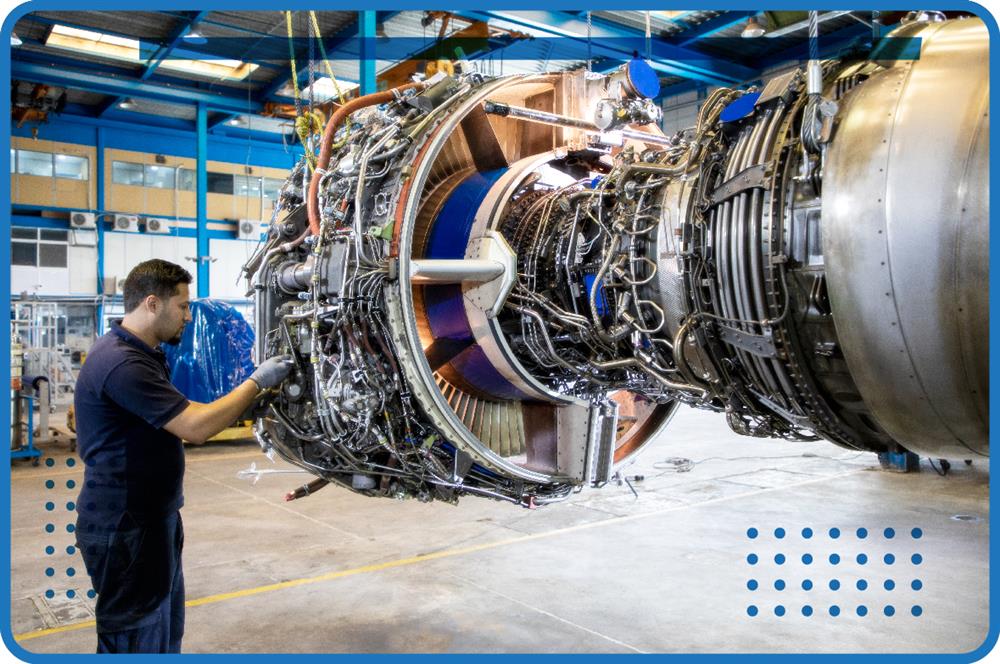

The Amman, Jordan-based company offers full overhauls of CFM56-3, -5B and -7B engines as well as the General Electric CF6-80C2 for widebody aircraft, and is currently conducting a feasibility study to add CFM Leap support to its capabilities.

For now, the company’s core business remains older CFM56 engines, for which maintenance demand has soared as airlines seek cover for new aircraft delivery delays and the reliability problems of newer technology engines.

“Five or six years ago when we used to quote $1 million for a CFM56-3 overhaul, people were shocked. Now we are quoting $1.5-1.6 million and the engines are getting repaired. The reason is the parts scarcity so prices are going up,” says Rihani.

To keep costs down for its customers Jordan Airmotive buys engines for teardown, repairing parts where it can and sending others, like airfoils and hot sections, to specialized shops. It also keeps a large inventory of ‘as-removed’ parts ready for repair if required.

To enhance its own capabilities, recently the engine MRO introduced a state-of-the-art high-speed grinder for either rotor or stator grinding on any type of engine. And from November, Jordan Airmotive will start testing eddy-current immersion checks for inspecting life-limited parts.

“This will be a very big saving as before we outsourced parts like the fan, and it took up to 35 days for them to come back, which is a long time compared with our 60 days’ average engine turnaround time.”